Community Reinvestment Act (CRA) rules and regulations require that Alden State Bank make available a Public File composed of the content posted below.

All content is made current as of April 1 each year. Please contact us at (716) 937-3381 should you have any questions.

{beginAccordion}

Written Comments

PUBLIC FILE COMMENTS

AS OF MARCH 31, 2025

The following comments have been received that specifically relate to the bank’s performance in helping to meet community credit needs for the current year or the prior two (2) calendar years:

2025: No comments received

2024: No comments received

2023: No comments received

CRA Performance Evaluation 9-30-22 DFS

The Alden State Bank CRA Performance Evaluation published by the Federal Reserve Bank of New York on 9-30-22 may be obtained by clicking here.

CRA Performance Evaluation 10-31-22 FRB

The Alden State Bank CRA Performance Evaluation published by the Federal Reserve Bank of New York on 9-30-22 may be obtained by clicking here.

List of Branches & Branches Opened or Closed

ALDEN STATE BANK BRANCHES

The main office of Alden State Bank is located at 13216 Broadway in the Village of Alden, Erie County, New York 14004 in Census Tract 0149.01. The main office of the bank has been located in the Village of Alden since 1916

The bank has three branches, as listed below:

- 13200 Broadway in the Village of Alden, Erie County, New York 14004 in Census Tract 0149.01. The branch was opened at that location in 2024.

- 5802 Broadway in the Town of Lancaster, Erie County, New York 14086 in Census Tract 0142.04. The branch was opened at that location in 1995 and has remained there.

- 6545 Transit Rd. in the Town of Clarence, Erie County, New York 14051 in Census Tract 0146.04. The branch was opened at that location in 2021.

As of March 31, 2025: No branches were opened or closed by the bank during the current calendar year (2025). One branch was relocated from the main office at 13216 Broadway in the Village of Alden to 13200 Broadway in the Village of Alden in Q4 2024. No other branches were opened or closed in the previous two calendar years (2022 and 2023).

{endAccordion}

{beginAccordion}

Services Offered at Alden State Bank Branches

{beginAccordion}

At Alden State Bank’s Alden Branch

Address: 13200 Broadway, Alden, New York

Hours of Operation:

Monday – Wednesday 9:00am – 4:00pm

Thursday 9:00am – 4:30pm

Friday 9:00am – 5:00pm

Saturday 9:00am – 12 noon

Drive-thru teller opens at 8:00am Monday – Friday

Walk-up ATM open 24 hours a day/7 days a week

Services Offered: The Branch is the main branch. It is a "full-service" branch offering all services available.

Loan Products Available:

- Residential mortgage loans

- Residential construction loans

- Home improvement loans

- Home equity loans

- Consumer installment loans (secured and unsecured)

- Consumer demand loans

- Small business loans and lines of credit

- Farm loans and lines of credit

- Commercial mortgage loans

- Commercial construction loans

- Loans to municipalities and

- Loans to non-for-profit organizations

Deposit Products Available:

- Handi Checking accounts

- Regular checking accounts

- Kasasa checking accounts

- Business checking accounts

- Kasasa savings accounts

- Passbook savings accounts

- Statement savings accounts

- Money fund savings accounts

- Certificate of deposit accounts

- Individual retirement accounts

- Health savings accounts (HSAs)

- Coverdell Educations savings accounts

- Christmas club accounts

- NOW accounts

Information on account requirements and fees relative to the above deposit products is available in the Deposit Account Product Guide, individual Truth in Savings disclosures and the Schedule of Service Charges and Fees.

There are no material differences in the availability or cost of services available.

At Alden State Bank’s Clarence Branch

Address: 6545 Transit Road

East Amherst, NY 14051

Hours of Operation:

Monday – Wednesday 9:00am – 4:00pm

Thursday 9:00am – 4:30pm

Friday 9:00am – 5:00pm

Saturday 9:00am – 12 noon

Drive-thru teller opens at 8:00am Monday – Friday

Walk-up ATM open 24 hours a day/7 days a week

Services Offered: The Branch is a “full-service” branch offering all services available.

Loan Products Available:

- Residential mortgage loans

- Residential construction loans

- Home improvement loans

- Home equity loans

- Consumer installment loans (secured and unsecured)

- Consumer demand loans

- Small business loans and lines of credit

- Farm loans and lines of credit

- Commercial mortgage loans

- Commercial construction loans

- Loans to municipalities and

- Loans to non-for-profit organizations

Deposit Products Available:

- Handi Checking accounts

- Regular checking accounts

- Kasasa checking accounts

- Business checking accounts

- Kasasa savings accounts

- Passbook savings accounts

- Statement savings accounts

- Money fund savings accounts

- Certificate of deposit accounts

- Individual retirement accounts

- Health savings accounts (HSAs)

- Coverdell Educations savings accounts

- Christmas club accounts

- NOW accounts

Information on account requirements and fees relative to the above deposit products is available in the Deposit Account Product Guide, individual Truth in Savings disclosures and the Schedule of Service Charges and Fees.

There are no material differences in the availability or cost of services available.

At Alden State Bank’s Lancaster Branch

Address: 5802 Broadway

Lancaster, NY 14086

Hours of Operation:

Monday – Wednesday 9:00am – 4:00pm

Thursday 9:00am – 4:30pm

Friday 9:00am – 5:00pm

Saturday 9:00am – 12 noon

Drive-thru teller opens at 8:00am Monday – Friday

Drive-thru ATM open 24 hours a day/7 days a week

Services Offered: The Branch is a “full-service” branch offering all services available.

Loan Products Available:

- Residential mortgage loans

- Residential construction loans

- Home improvement loans

- Home equity loans

- Consumer installment loans (secured and unsecured)

- Consumer demand loans

- Small business loans and lines of credit

- Farm loans and lines of credit

- Commercial mortgage loans

- Commercial construction loans

- Loans to municipalities and

- Loans to non-for-profit organizations

Deposit Products Available:

- Handi Checking accounts

- Regular checking accounts

- Kasasa checking accounts

- Business checking accounts

- Kasasa savings accounts

- Passbook savings accounts

- Statement savings accounts

- Money fund savings accounts

- Certificate of deposit accounts

- Individual retirement accounts

- Health savings accounts (HSAs)

- Coverdell Educations savings accounts

- Christmas club accounts

- NOW accounts

Information on account requirements and fees relative to the above deposit products is available in the Deposit Account Product Guide, individual Truth in Savings disclosures and the Schedule of Service Charges and Fees.

There are no material differences in the availability or cost of services available.

{endAccordion}

{beginAccordion}

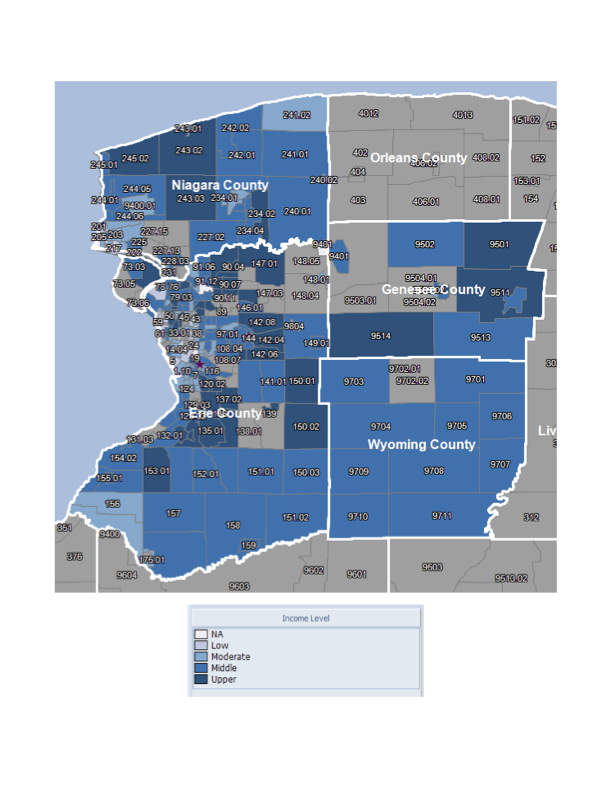

Assessment Map 2025

HMDA Disclosure Statement

Home Mortgage Disclosure Act Notice

The Alden State Bank’s 2024 HMDA data about our residential mortgage lending are available online for review. The data shows geographic distribution of loans and applications; ethnicity, race, sex, age, and income of applicants and borrowers; and information about loan approvals and denials. The Alden State Bank’s HMDA Disclosure Statement May be obtained on the Consumer Financial Protection Bureau (Bureau’s) web site at www.consumerfinance.gov/hmda.

LTD Ratio

Loan to Deposit Ratios

12/31/2024

| 3/31/2024 | 6/30/2024 | 9/30/2024 | 12/31/2024 | |

| LOANS (RC-4B) | $279,276,000 | $277,463,000 | $274,002,000 | $279,584,000 |

| DEPOSITS (RC-13A) | $355,496,000 | $356,497,000 | $357,648,000 | $353,734,000 |

| LTD RATIO | 78.56% | 77.83% | 76.61% | 79.04% |

{endAccordion}